winhorse/iStock Unreleased via Getty Images

Japan Is Reopening

This is an investment I have been thinking about ever since the pandemic started. In my eyes, the Japan Rail system is one of the most optimized systems in the world, and has the benefit of Japanese fiscal conservative practice to bank on. While it will be some time before the country to allow full entry, and even more to reach back to 2019 levels of traffic, there are other factors to consider. This includes the balance between US and Japanese yields, the sliding Yen, and even consumption within the country. I will cover these points and more to initiate the first stage of due diligence required for an investment in Central Japan Railway Company (OTCPK:CJPRY), and in combination with articles on JR East (OTCPK:EJPRY), West (OTCPK:WJRYY), and Kyushu (OTC:KYYHF).

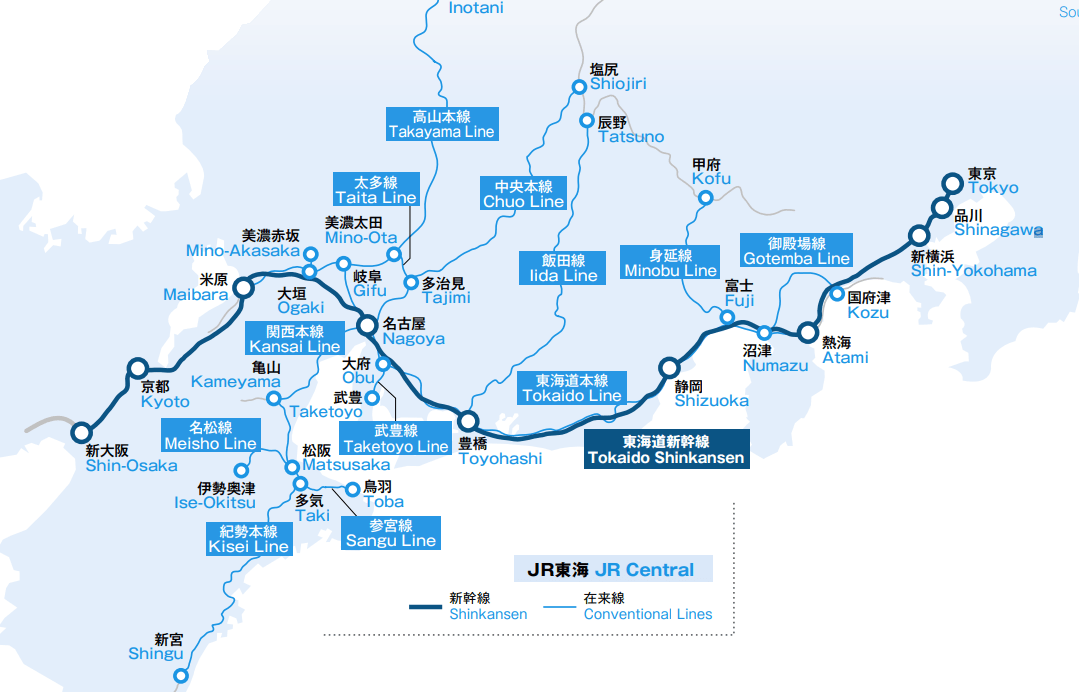

JR Central

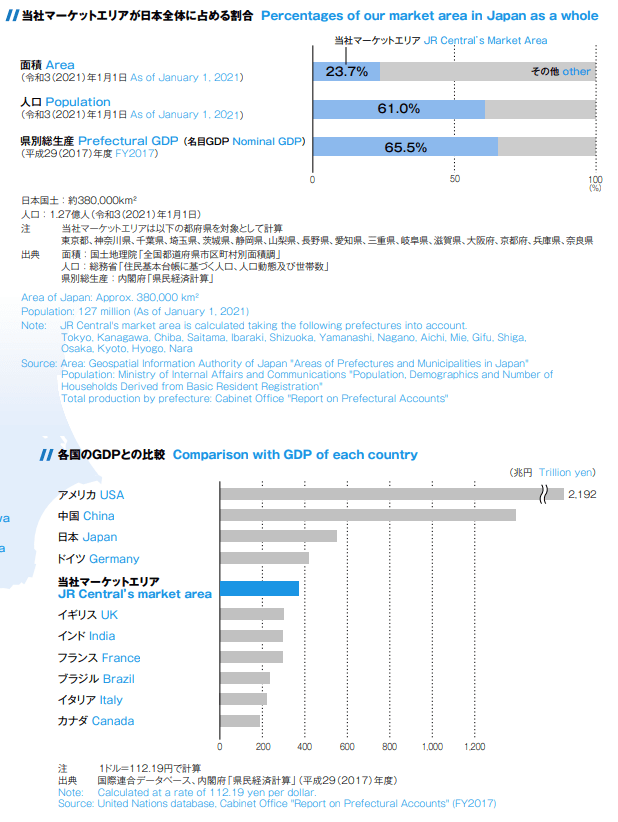

Central Japan Railways, referred to as JR Central, is currently the largest of the Japan Rail segments thanks to their operation of the Tokaido Shinkansen, the main high-speed rail artery between Tokyo and Osaka. This artery is also home to the major cities of Yokohama, Nagoya, and Kyoto, and the region represents a GDP of over $3 trillion USD. This places it right between Germany and the UK in terms of size, fifth in the world. In other words, JR Central covers 65% of Japan’s national GDP while only covering 24% of Japan’s land area.

JR Central

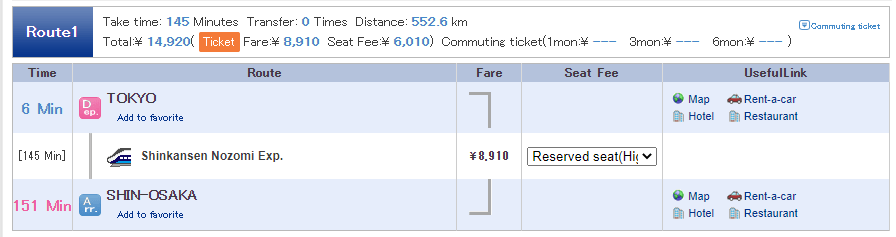

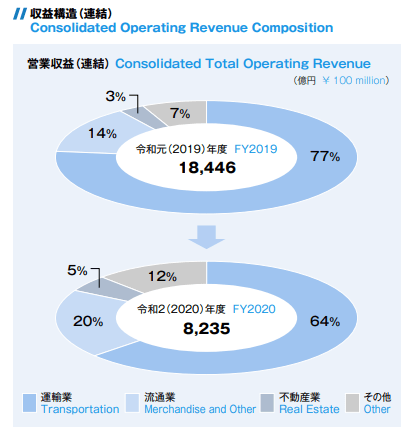

As is typical of Japanese conglomerates, JR Central does more than just own rail lines and operating trains. The company also owns, operates, and develops real estate around train stations, and if you have been to Japan, you know major train stations are mini-cities in themselves. A full list of subsidiaries can be found here, but they cumulatively amount to a minority 20-30% of revenues per year. Transportation, and the Tokaido Shinkansen in particular, remains the main driver of revenues, accounting for between 88-92% of transportation revenues per year. Considering the 2 and a half hour train journey between Tokyo and Osaka is usually well over $100 per rider, one way, you can see why this is the case after I cover ridership numbers.

Hyperdia JR Central

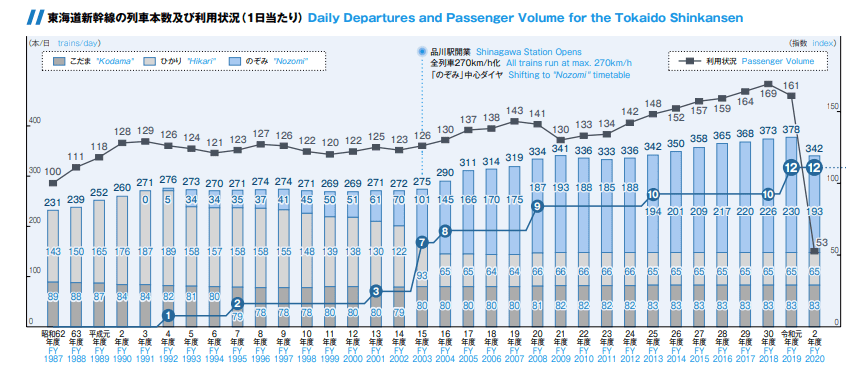

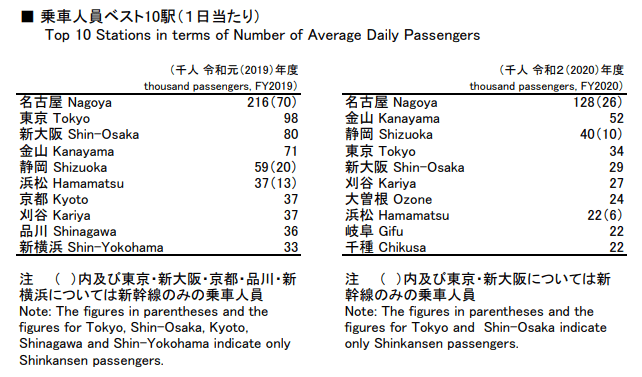

In 2021, the company saw average monthly ridership volume increase YoY when compared to pandemic year 2020. While the country was slow to reopen, and remains closed to tourism, ridership numbers had a healthy rebound. Exact ridership numbers are not shown, but indexed to 1987 levels of “100.” Between 2008 and 2019, huge growth in ridership occurred, spurred on by a healthy economy, huge increase in tourism, and operational efficiency. However, the pandemic made ridership drop by 67% YoY. For the full year 2021, ridership rose to 141, an increase of 166%. As for numbers of passengers, prior to the pandemic, major stations had between 33 and 216 thousand per day, but updated figures for 2021 have not been released yet. More insights can be gained by looking at the revenues instead of these ridership metrics, but it is good to see a significant rebound already. This is exclusively based on Japanese national travelers, as the country only recently opened to business travel.

JR Central JR Central

An issue arising outside of reduced passenger traffic is the weakening Yen. Japanese fiscal policy remains focused on low rates and so the Yen’s value has been plummeting as higher yields can be found in the US and Europe. I lack the FOREX expertise to determine how this will affect short-term financial performance for JR Central, but I assume the main impact will be electricity costs. FOREX impacts would be felt more if the company required purchasing foreign components, but I believe most work is done in-country. Also, trains are extremely efficient compared to other forms of mass transportation, whether air, bus, or car, and trains may be able to offer even more competitive pricing that fuel hungry planes or ICE vehicles.

Similarly, the Tokaido Shinkansen is already the preferred mode of transport between Tokyo, Nagoya, and Osaka, due to time efficiency compared to airplanes and driving. As can be seen, business and national tourism are returning to pre-pandemic levels, and this has a significant impact on the company’s financials. The only worry will be based on the Japanese economy moving forward, but I find the temporary weakness to be a time to pounce on the shares. I will discuss the economic and touristic impacts more in my article on JR East, coming soon.

I am ready to be back on the Shinkansen. Mt Fuji March 2019. (Author)

Financial Summary

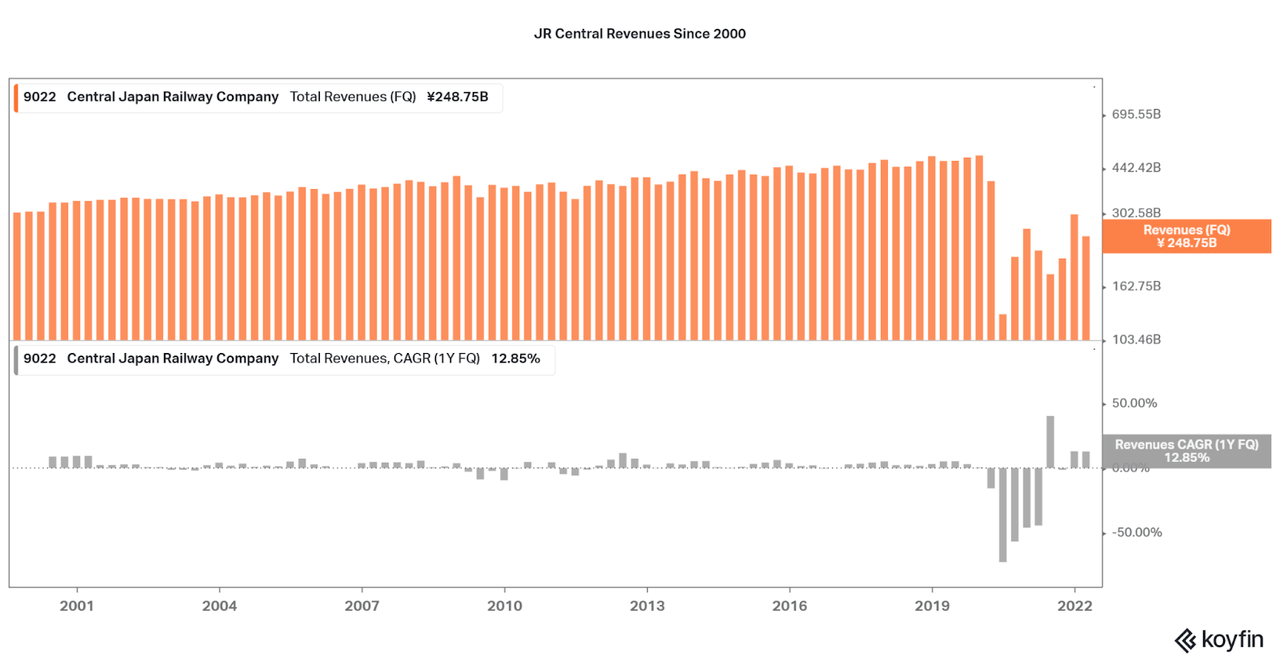

As one of the largest rail systems in the world, JR Central rightfully earns copious amounts of revenues. In fact, revenues reached a peak of $17.2 billion for the year leading up to the pandemic – compared to a low of $14 billion in 2014. However, as a fully expanded company with a shrinking population and stagnant GDP, revenue growth is minor. As is expected the pandemic wreaked havoc on the industry, with revenues almost coming to a standstill due to lockdowns. While rebounding slightly, overall revenues are about half of their former levels. The increase over the past few quarters has been a result of increased national travel and tourism.

A major issue remains related to both national and international travel. As JR Central is the major transportation hub for the top three economic regions of Japan, a lack of business travel via Shinkansen is hurtful. While international business travel has returned as of March 2022, international visitor levels remain far below 2019 levels. Perhaps the pandemic has shifted priorities away from in-person meetings to working from home, even nationally, reducing Shinkansen use. Whether this lasts indefinitely or travel slowly returns to normal is unknown. I believe the picture will not be clear until tourism returns, and it is not known when this will occur.

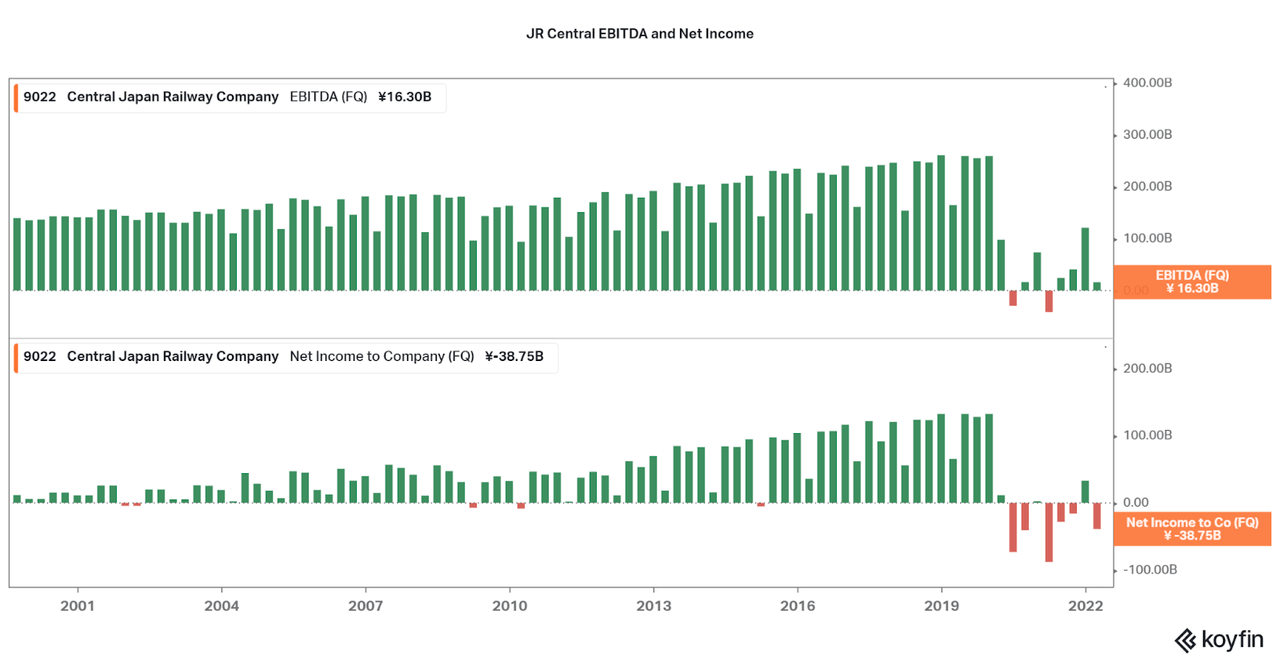

Koyfin

When revenues do come back, I expect profitability to return to form as well. The 2012-19 bull cycle for JR Central allowed for a sharp rise in earnings, mostly thanks to significant tourism growth. Japan has always been famous for their culture, but this had yet to translate into significant tourism until recently. However, I will also note that the company has been working on their own internal operational efficiency, and this has also played its part in improving profitability. Items include continued CAPEX around ticketing services, station infrastructure, and developing optimal and energy efficient trains and routes. While expensive, prior profitability and conservative expenditures continue to allow the lines to perform well. It is good to see that EBITDA was able to return positive through 2021 and into 2022, and I believe this bodes well even if revenues are slow to rise.

Koyfin

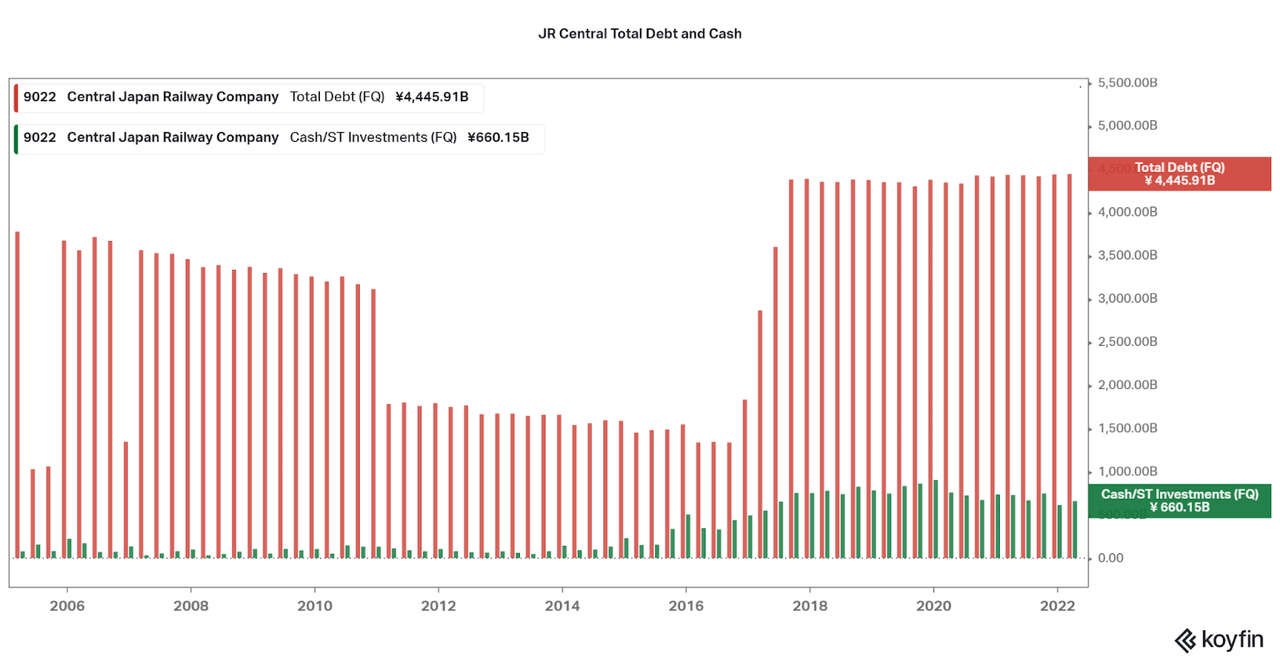

One issue that can be brought up in regards to JR Central is their significant debt load. A large sum was taken up in 2017-2018 in order to begin construction of the Chuo Line, a magnetic levitation (maglev) shinkansen. This famous project has been in the works for at least 20 years, and is finally approaching initial completion in 2027. In fact, a majority of the line has been built (from scratch in the interior of the country rather than along the coast) and only the crossing of the large Southern Alps in Shizuoka Prefecture is left. When completed, travel speeds up to 500 kilometers per hour (310 mph) will reduce Tokyo to Nagoya travel times by half. While the pandemic puts a spanner in the works, adds risk due to debt and reduced revenues, and may delay completion of the new line, I find that JR Central remains financially rock solid for long-term safety.

Koyfin

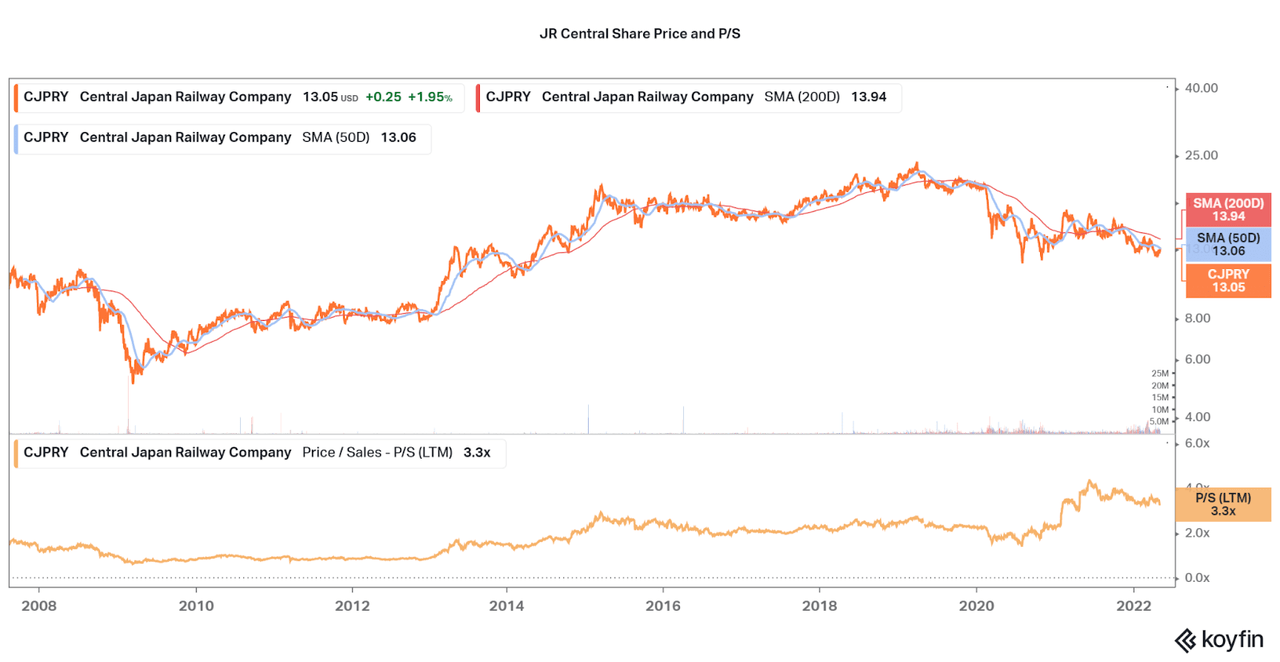

While there is little evidence that one of the largest rail providers in the world is financially weak, issues exist and will impact the share price. One important one is that the valuation of the company has failed to track in line with financial performance. Due to the safety provided, investors have only sold the stock by about 40% from all-time highs in 2019. As such, the current Price to Sales ratio is double what it normally trades, around 2.0x. Unfortunately, this means that upside is limited due to the fact that a return to normal revenues will only bring the valuation back to normal at the same time. As such, margin expansion is not expected at current financials. However, the key indicators will be profitability and the Chuo Line progress, and successful inroads may lead to the valuation to remain elevated.

OTC shares as reference. (Koyfin)

Conclusion

While it is often difficult to predict market bottoms, I find there is currently more chance for improvement rather than a decline, financially at least. Favorable tailwinds include the rise of international visitors, now students and sponsored business, with tourists set to return, eventually. The uncertainty, however, is the major issue plaguing the share price and leading to new lows. I personally feel that we are approaching a time where the share price will begin trickling upward, in line with ridership numbers. Also look to improving profitability and economic stability in the country.

Current Yen weakness may not be an issue as most costs should remain in-country, and foreign visitors will bring stronger currencies. However, tourism is less of an impact in this economically important region, and business travelers are the high margin revenue source that is needed. I will be watching the monthly visitor and ridership numbers intently, and I may begin adding shares of the company in multiple phases over the next few quarters. Then, by the time tourism returns, look for strong upside potential. It certainly doesn’t hurt to add a small portion of a safe, international asset to your portfolio.

*As of May 6th, Prime Minister Kishida seems like the government is considering opening further in June 2022, a favorable sign regardless of the final timeline.

Thanks for reading.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

More Stories

Hotels in Bangalore – Accommodations For Everyone

What is a Flashpacker? 10 Traits That Separate Flashpackers From Backpackers

Hassle-Free Money-Saving Travel Tips